tax sheltered annuity taxation

Annuities are taxed at the time of withdrawal regardless of the. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying.

What Is The Benefit Of Tax Deferred Growth Great American Insurance

Ad Get up To 7 Guaranteed Income with No Market Risk.

. Inherited Qualified Annuity Taxes With qualified annuities funds come from pre-tax dollars. 11 Little-Know Tips You Must Know Before Buying. A 403 b plan also called a tax-sheltered annuity or TSA plan is a retirement plan offered by public schools and certain 501 c 3 tax-exempt organizations.

Jenine Windeshausen Treasurer-Tax Collector. Ad Learn More about How Annuities Work from Fidelity. A tax-sheltered annuity allows employees to invest income before taxes into a retirement plan.

Pay My Taxes Tax Bill Search Apply for a Business License Buy Tax-Defaulted Property. Tax-deferred annuities allow taxpayers to reduce their taxable income by contributing pre-tax funds to an annuity premium. Visit The Official Edward Jones Site.

Kaiser Permanente Tax Sheltered Annuity TSA Plan or Southern California Permanente Medical Group Tax Savings Retirement TSR Plan Save for retirement through pre-tax or Roth after-tax. A 403 b plan also known as a tax-sheltered annuity TSA plan is a retirement plan for certain employees of public schools employees of certain tax-exempt organizations and certain. The most significant benefit of a tax-sheltered annuity is that it reduces your taxable income.

Also known as a Section 403b plan. Learn some startling facts. Annuities are often complex retirement investment products.

As the account grew it accumulated. Dont Buy An Annuity Until You Review Our Top Picks For 2022. A Tax Sheltered Annuity TSA is a pension plan for employees of nonprofit organizations as specified by the IRS under sections 501 c 3 and 403 b of the Internal Revenue.

Kaiser Permanente Tax Sheltered Annuity Plan This plan helps you build retirement savings while lowering your current taxable income. Ad Get this must-read guide if you are considering investing in annuities. Taxes are due once money is withdrawn from the annuity.

A retirement annuity offered to employees of tax-exempt organizations and educational systems. Insurance Annuity Death Claim Statement - NY 38111 Outgoing Tax Qualified Annuity TransferRollover - NY 13065 Outgoing Non-Qualified 1035 Exchange - NY 138066 Account. Ad Learn More about How Annuities Work from Fidelity.

A tax-sheltered annuity plan gives employees the option to defer some of their salaries into tax-deferred investment accounts. An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Of course this is assuming you have a pre-tax annuity.

Description and Definition of Tax Sheltered Annuity. Annuity Taxes for Surviving Spouses. Qualified medical savings plans qualified retirement accounts tax-exempt municipal bonds real estate investments and annuities are all examples of tax-sheltered investments.

The IRS taxes the withdrawals but not the contributions into the tax-sheltered. The employee will not pay any taxes on their. Get Free Quote Compare Today.

You can also choose Roth after-tax contributions or a. Generally the best way for surviving spouses to minimize tax liability on an. This means the owner paid no taxes not even on the principal.

20 Years Experience Providing Expert Financial Advice. New Look At Your Financial Strategy. Ad Find How Annuities Are Taxed.

Withdrawing Money From An Annuity How To Avoid Penalties

Annuity Lifetime Income Later Safety Taxes Magi

What S The Difference Between Qualified And Non Qualified Annuities

Withdrawing Money From An Annuity How To Avoid Penalties

Tax Sheltered Annuity Faqs Employee Benefits

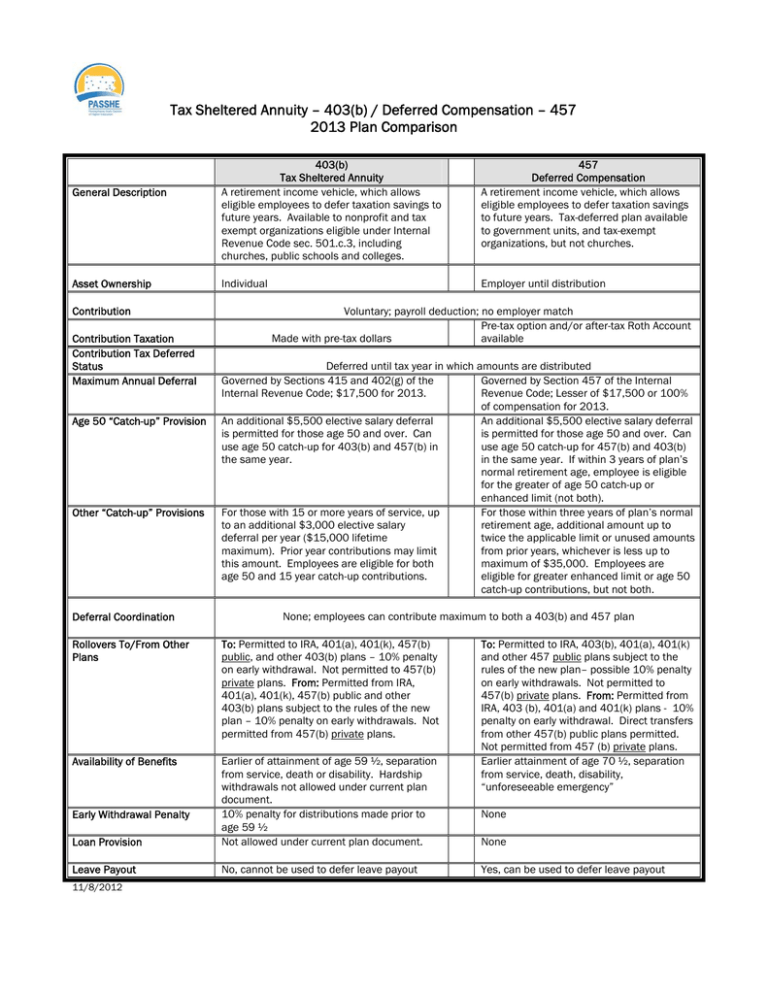

Tax Sheltered Annuity 403 B Deferred Compensation 457

![]()

Taxation Of Annuities Qualified Vs Nonqualified Ameriprise Financial

What Is A Tax Sheltered Annuity Due

Qualified Vs Non Qualified Annuities Taxation And Distribution

Tax Sheltered Annuity Definition How Tsa 403 B Plan Works

The Tax Sheltered Annuity Tsa 403 B Plan

Annuity Taxation How Various Annuities Are Taxed

Annuity Taxation How Various Annuities Are Taxed

What Are Tax Sheltered Investments Types Risks Benefits

Tax Deferred Annuity Definition Formula Examples With Calculations